Brisbane Property Boom: Why Inflation Will Cause Prices to Rise.

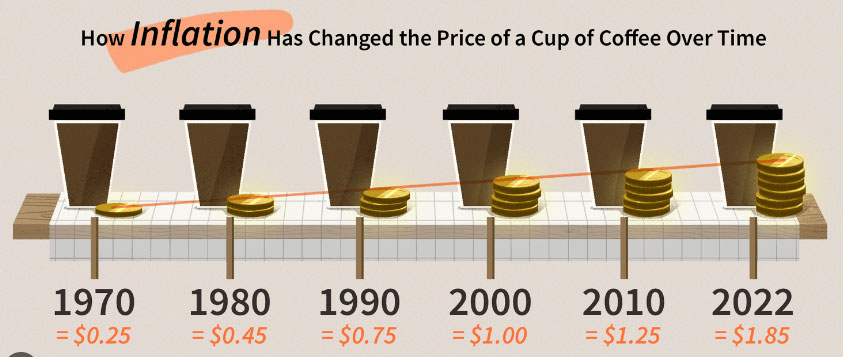

Let’s start with a quick definition of inflation. Inflation is the rate at which prices for goods and services increase over time. When inflation is high, your money loses value, meaning it can buy less than it could before. This is why it’s important to invest your money in assets that can keep up with inflation, such as real estate or gold, stocks whatever your want to pick as your vehicle. In my case and the case of this video it’s going to be Real Estate. A great example is the price of coffee in 1970 it was .25 cents, then 10 years later in 1980 it jumped to .45cents, in 1990 .75 cents, in 2000 $1, in 2010 $1.25, in 2022 $1.85 (source investopedia).

Hey, I’m pretty sure in 2022 I was paying at least $5 for a coffee but you get the point. Solid assets, houses, gold, and stocks go up in value or appreciate in value while cash continues to lose value. Hence you could buy a house and land pack back in the day for $80k. But why I bring inflation up now more than ever is because it is causing house prices to soar in parts of Brisbane due to building costs.

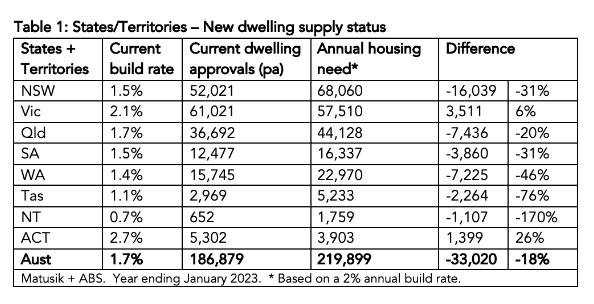

You can buy a 4 bed 2 bath for $500k but to build that same property in that same location you are looking at a build cost of $700k. What does that mean simply when you do your revaluation in 12 months’ time your $500k property should value you up to $600k at least? This is another major issue in Brisbane in particular, due to the cost to build soaring houses not getting built, which here are the numbers just for QLD, dwelling approvals 36,692 annual housing need 44128 difference -7436. That means we are short by 7436 houses in 2023.

Real estate is a great way to protect your wealth from inflation for a few reasons. First, real estate tends to appreciate in value over time being a solid asset hence the term property is forgiving. That term was plagued because if you overpaid, eventually the price would come up due to inflation and demand.

This means that the property you buy today could be worth more in the future, allowing you to sell it for a profit. For example that coffee you could have purchased in 1970 45 cents you could sell the same coffee for $1.85, now do that same equation with $50,000. Additionally, real estate provides a steady income stream through rental income. As inflation rises, you can adjust your rental rates to keep up with the increased cost of living, so

Another benefit of investing in real estate is the ability to leverage your investment. As inflation rises, the value of your property increases, allowing you to pay off your mortgage with cheaper dollars. So, for example, you purchase the property for $500,000 now but in 5 years’ time it’s worth $700,000 that means you will have $200,000 in equity and if you use the coffee example early that coffee you can get for $1.85 now by then will cost $2.5 so technically money is worth less so you will be getting paid more.

Hope that makes sense, well to put it simply you will be earning or you should be earning more money due to inflation which will make it easier to pay down the debt eventually.

But how do you get started with real estate investing? The first step is to educate yourself on the real estate market and investment strategies. There are many resources available online, including books, podcasts, and blogs. You can also attend real estate investment seminars and network with other investors to learn more about the industry.

When you’re ready to invest in real estate, there are a few things to keep in mind. First, make sure to do your due diligence on the property you’re interested in. This includes researching the neighbourhood, checking property values, and getting a home inspection. You’ll also want to consider the rental market in the area to ensure you can charge enough rent to cover your expenses.

Or alternatively, I run a Buyer’s Agency business where I sit down with you and can provide a free 1 on 1 strategy where I can help you come up with a strategy completely free to help you save a lot of time and hopefully steer you in the right direction.